How can a new brokerage make a significant impact on savings in terms of time, frustration, ROI?

Having made the decision to become an FX brokerage operation, one of the major steps is to decide the type of trading platform to deploy. If cost is no object, then you can simply buy a state-of-the-art server along with a comprehensive trading platform and you’re set.

However, this may not be the optimal way to dive into what can be an extremely risky business. Perhaps caution is a better policy to adopt, and fortunately there are several brokerage start-up options out there that won’t break the bank.

There is a general trend in business today to go lightweight. Companies realize that their customers are tired of purchasing expensive hardware, which is often outdated as soon as it’s installed.

Many service industries are looking to provide light, easily upgradeable, transparent solutions that they can then sell to their clients “as a service”, instead of as a product that they would need to purchase and install.

These technologies became known as SaaS, meaning Software as a Service. Should the need arise to deploy hardware components, then these are purchased under replacement service contracts from large, global hardware suppliers such as IBM or HP.

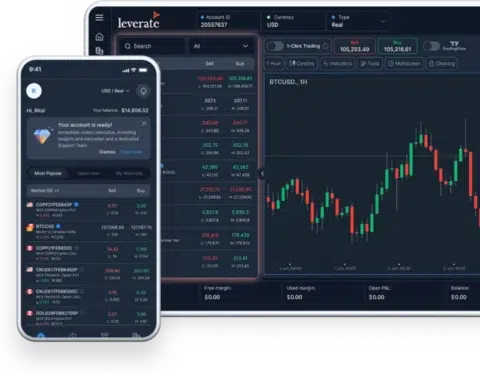

This trend is also present in the world of Forex trading platforms. The purchase of so-called white label (WL) solutions can be used to reduce the initial expense of setting up a brokerage. Such a move can also simplify the complex logistics that building such a business might involve.

This includes connecting to a brokers’ client base, configuring the payment systems, and general system connectivity. By choosing to take the white label route, a new brokerage can leverage itself off the experience of a company that has already set up such a service.

“By hiring the services of a company that already has all the systems in place, a new brokerage makes significant impact on savings in terms of time, frustration, and more importantly – ROI”, says Maoz Tenenbaum, VP of Sales at Leverate.

“As a technology and service provider for brokerages, we get a lot of calls from people who wish to offer their clients the best trading platforms on the market, but at this point in their life, still don’t have the funds for a full ownership. Our white-label solutions for brokers address that issue, whether it is a MetaTrader platform hosted on our servers, or a complete solution that covers all aspects”.

The only costs that the new brokerage incurs in a white-label agreement, are a monthly rental fee charged by the established brokerage operator. Normally, the newcomer will also be charged a set-up fee, which also includes the cost of configuring the new company’s server equipment.

As with setting up any complex business operation, there are pros and cons. However, with a professionally constructed business plan, a strong drive, and vision, the new brokerage can be up and running within a few months. Costs are reduced, which enables the new brokerage to focus on business development.

By depending on a “parent” service, maintenance becomes less of a headache. If the system fails, then you call in the maintenance team. If they can’t fix the issue, then they don’t get paid. It’s a well-tried business model.

On the cons side there are still considerations of which a new brokerage should be aware. For example, the new company will start small, and as such will be unable to manage many deals or clients.

As the business grows then there will be a requirement to employ greater server services from the established brokerage company.

Ultimately, finances will dictate that the new company will have no option but to buy their own full system and take a quantum business leap.

Purchasing services from a larger company can also mean that you are one of a series of smaller brokerage companies all competing for attention from the larger enterprise. You will find yourself sharing resources that will become yours alone once you have decided to purchase your own platform.

In summary, going WL is certainly the preferred option for newcomers to the brokerage business. Many top brokerage companies started by using this model. Initial technological challenges can be overcome, and valuable resources can then be used in marketing and other promotional activities.

[more_in]

“Leverate’s clients have the option to choose their yellow brick road into the Forex world”, says Maoz. “They can take full ownership of their trading platform and full control of every aspect in their business with our customizable options, or go for a more affordable white label solution, that they can use as a springboard. Our WL option includes with the trading platform a host of other services, be it payment processing, regulation and risk management, which make it adaptable to our clients’ needs for success in today’s vibrant reality”.